Decide the overall quantity of economic exercise sourced to Oregon that the enterprise realized over the course of the yr. Dont embrace receipts from objects which can be particularly excluded from business exercise.

Companies topic to the CAT can be taxed at a fee of 057 on taxable receipts much less deductions.

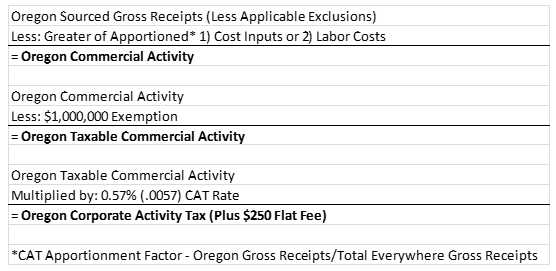

Oregon cat tax calculation. Oregon wheat Growers League. At this level the CAT calculation turns into much less advanced. If the taxabl e business exercise is 1 million or much less the taxpayer owes no tax below the CAT22 If the taxable business exercise exceeds 1 million the taxpayer owes a tax of 250 on the primary 1 million and the surplus taxable business exercise over 1 million is taxed on the.

Register for the Company Exercise Tax. Subtract 1 million out of your taxable Oregon business exercise from step 1. The CAT is computed as 250 plus 057 of Oregon-source business exercise over 1 million.

Oregon Wage Tax Calculator for the Tax 12 months 202122. The brand new Company Exercise Tax CAT can be imposed on taxable business exercise in extra of 1 million at a fee of 057 plus a flat tax of 250. Oregons CAT is measured on a businesss business activitythe complete quantity a enterprise realizes from transactions and exercise within the regular course of enterprise in Oregon.

Apply a 76 company revenue tax fee on company revenue above 1 million. The 1 million business exercise exemption is utilized to. The CAT is utilized to taxable Oregon business exercise in extra of 1 million.

This step is a number of flowcharts price of calculations. F or 2020 the LTD tax fee is 075. Multiply this quantity by complete labor prices or value of inputs paid to different companies.

Oregon Affiliation of Tax Consultants 3075 SE. The Oregon Wheat Growers League joins its companions in celebrating a serious win for agriculture at this time with the passage of agriculture-specific fixes to the Company Exercise Tax CAT. Taxable Oregon business exercise 1 million threshold x 057 tax fee 250 Oregon Company Exercise Tax legal responsibility.

It was 074 for 2019 and is ready to extend 01 every year via 2025 when the speed will attain after which keep at 080. Final yr Oregon Governor Kate Brown signed Home Invoice HB 3427 imposing a brand new gross receipts tax efficient for tax years starting on or after January 1 2020. Our calculator has lately been up to date to incorporate each the most recent Federal Tax Charges together with the most recent State Tax Charges.

In case your taxable Oregon business exercise is 1 million or much less your CAT. An quantity equal to 80 p.c of the tax computed on annualized taxable business exercise. Whereas the state revenue taxes deal a heavy hit to some earners paychecks Oregons tax system isnt all unhealthy information in your pockets.

Advert Get your taxes sorted with our straightforward to make use of calculator. Or Labor prices. A taxpayers first 1 million of Oregon receipts can be exempt from the tax although impacted taxpayers face a minimal tax of 250.

Multiply the outcome by 057 p.c tax fee plus 250. For tax years starting on or after January 1 2020 and ending earlier than January 1 2022 80 p.c of the tax for the tax yr. The best way to calculate Company Exercise Tax CAT Line 1.

The Oregon CAT is a tax on modified gross receipts as a result of it supplies taxpayers with a subtraction from taxable business exercise of 35 p.c of the higher of the taxpayers annual. Suite 110 Hillsboro OR 97123-8187. Signed on Could 16 this new company exercise tax CAT can be owed by firms with annual in-state revenues exceeding 1 million and is anticipated to lift 1 billion per yr for Oregon faculties.

Apply a 66 company revenue tax fee on company revenue as much as 1 million. Though HB 3427A refers to a company exercise tax the tax applies to many types of companies together with. Taxable Oregon Business Exercise 1 million x 0057 250 Oregon CAT legal responsibility When you have further questions please ship them to the CAT coverage crew at.

Our calculator has been specifically developed in an effort to present the customers of the calculator with not solely how a lot. Oregon Revenue Taxes. As soon as the quantity of economic exercise sourced to Oregon is set the CAT imposed is the same as 250 plus the product of the taxpayers taxable business exercise for the calendar yr in extra of 1 million multiplied by 057.

The tax is computed based mostly on a calendar yr starting Jan. Solely taxpayers with greater than 1 million of taxable Oregon business exercise can have a fee obligation. CAT Technical Repair Passes in Particular Session.

1 2020 no matter a taxpayers yr finish for accounting and federal revenue tax functions. Oregon was one of many first Western states to undertake a state revenue tax enacting its present tax in 1930. The tax is computed as 250 plus 057 p.c of taxable Oregon business exercise of greater than 1 million.

The CAT is utilized to Oregon taxable business exercise in extra of 1 million. Use exception 3 on Type OR-QUP-CAT. Consequently the Oregon CAT tax base would be the complete business exercise or receipts sourced to Oregon much less the 1 million exemption and deductions for 35 p.c of value inputs or labor prices of a unitary group of individuals.

Estimated tax fee is the same as or greater than 25 p.c of any one of many following. That prime marginal fee is among the highest charges within the nation. The Oregon CAT defines value inputs as the price of items offered as calculated below IRC Part 471.

Nonetheless taxpayers together with unitary teams exceeding 750000 of Oregon business exercise are required to register for the CAT inside 30 days of assembly the edge. From Oregon and divide by gross sales all over the place. Helps IRS FIFOSpecific ID.

Decide your Oregon Company Exercise Tax legal responsibility. You’ll be able to use our Oregon State Tax Calculator to calculate your complete tax prices within the tax yr 202122. No tax is owed if the individuals taxable business exercise doesn’t exceed 1 million.

Quantity of economic exercise sourced to Oregon. A taxpayer topic to CAT is allowed a subtraction of 35 of the higher of the taxpayers annual value enter or labor prices in opposition to Oregon – supply business exercise ie base of the tax HB. The CAT just isn’t a transactional tax resembling a retail gross sales tax neither is it an revenue tax.

It consists of 4 revenue tax brackets with charges rising from 475 to a prime fee of 99. A single entity firm information tax returns in Jurisdiction A that has an enacted statutory tax fee of 9 In 20X0 the corporate apportioned 100 of its revenue to Jurisdiction A On the finish of 20X0 the corporate had web taxable momentary variations of 500 anticipated to reverse at varied occasions over the following 5 years. Subtraction from gross receipts.

Taxable Oregon business exercise 1 million threshold x 057 p.c tax fee 250 Oregon Company Exercise Tax legal responsibility In case your taxable Oregon business exercise is 1 million or much less your CAT tax legal responsibility is zero.

Q A How To Navigate The Oregon Company Exercise Tax

Q A How To Navigate The Oregon Company Exercise Tax

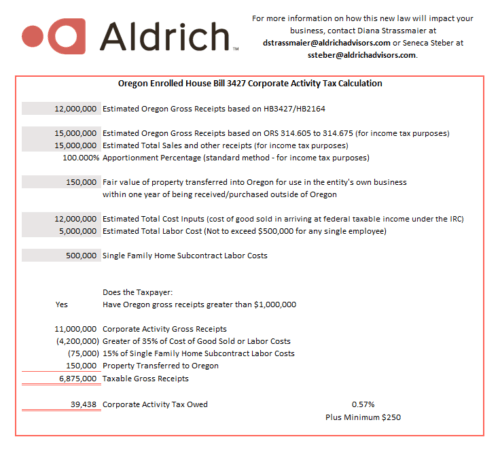

Company Actions Tax In Oregon Aldrich Cpas Advisors

Company Actions Tax In Oregon Aldrich Cpas Advisors

Oregon Company Exercise Tax And Its Impact On Dental Practices Jones Roth Cpas Enterprise Advisors

Oregon Company Exercise Tax And Its Impact On Dental Practices Jones Roth Cpas Enterprise Advisors

Oregon Passes New Company Exercise Tax Vancouver Enterprise Journal

Oregon Passes New Company Exercise Tax Vancouver Enterprise Journal

Oregon Gross Receipts Tax For Transportation And Logistics

Oregon Gross Receipts Tax For Transportation And Logistics

2021 Portland Tax Modifications Bluestone Hockley Portland Property Administration

2021 Portland Tax Modifications Bluestone Hockley Portland Property Administration

Portland Neighborhoods Portland Map Portland Neighborhoods Portland Oregon Map

Portland Neighborhoods Portland Map Portland Neighborhoods Portland Oregon Map

New Oregon Company Exercise Tax Cat Business Property Administration Salem Oregon Willamette Valley

New Oregon Company Exercise Tax Cat Business Property Administration Salem Oregon Willamette Valley

How Oregon S Pending Tax On Business Exercise Will Have an effect on Property Managers And Housing Suppliers By Hfo Funding Actual Property Issuu

How Oregon S Pending Tax On Business Exercise Will Have an effect on Property Managers And Housing Suppliers By Hfo Funding Actual Property Issuu

![]() Oregon Company Exercise Tax Defined Brenner

Oregon Company Exercise Tax Defined Brenner

The Oregon Company Exercise Tax Is Coming Jones Roth Cpas Enterprise Advisors

The Oregon Company Exercise Tax Is Coming Jones Roth Cpas Enterprise Advisors